Experian

In this Experian Review we will be looking at the following aspects of the credit reporting experts:

Overview

Experian let you sign up and check your Experian credit score for free. This is not a limited time offer, this is a ‘for life’ deal. Your file is periodically updated every 30 days as long as you login regularly. You might also be interested in reading out Experian CreditExpert review, which will provide more information on the alternatives available.

To compliment this they offer a wealth of advice on how to control your finances and improve your credit score.

With Experian you can compare different financial packages such as loans, credit cards and mortgages and see which one is most suited to your needs.

You can also request a copy of your credit report for a very small charge. They do also offer a more indepth service called CreditExpert, although there is a monthly fee for this product. Your first month, however, is completely free.

The following Experian review is based on our personal observations of their services, ease of use, quality of advice and all-round experience. It is designed to give you an unbiased, honest opinion of one of the UK’s biggest credit-reporting agencies.

What is Experian?

So, what is Experian, then? Experian are a consumer credit reporting agency that serves society, businesses and individual consumers by collating and providing relevant financial data.

Experian hardly need an introduction. Over one billion people around the world use their services and they are one of the UK’s three biggest credit rating agencies along with Call Credit and Equifax.

If a financial institute wants to check on your fiscal history then the chances are they are going to use Experian to do it.

Here are a few quick facts about Experian to get an idea of the scale of the company:

- Founded in 1996.

- They are the UK’s most trusted credit score provider

- They expanded rapidly and now serve 37 countries around the world with finding a suitable credit service and supplying financial analytical data.

- The Dublin-based company employ 17,000 people.

- They are listed on the London Stock Exchange.

- They also trade on the FTSE 100 Index.

Make no mistake – this is a big company. If you want your credit report with Experian, make sure to view the report now.

Experian Credit Report Login

To access your Experian Credit Report, the first thing you need is an Experian account. This is free to do and is extremely easy to set up.

Signing up for the free service takes just a couple of minutes and is fairly self explanatory. Follow the steps below if you are uncertain in any way as to how this is done.

- Click on the link on our site

- Go to sign up for FREE in the top right hand corner of the page

- Input the details you are asked for (name, address, date of birth, etc.)

- Answer the security questions

- That’s all there is to it. A free Experian account in a matter of minutes.

Where Experian is different to other online experiences – such as Equifax credit ratings – is the security questions that it asks.

In addition to the usual personal details we were also asked to confirm information about a personal bill from a set of multichoice answers. This was comforting as it shows they take their security protocols very seriously.

The final screen before the account was confirmed asked about our annual income and residential status.

This did feel a little intrusive but when you take into account they will use that information to provide you with financial offers that you would qualify for it is more than understandable.

The Experian Credit Report login in was straightforward. All that is required is a username or email address, password and an additional security question.

If you forget any of these there is a link to reset them provided you answer the correct security questions. Marks earned here for ease of use and attention to security measures.

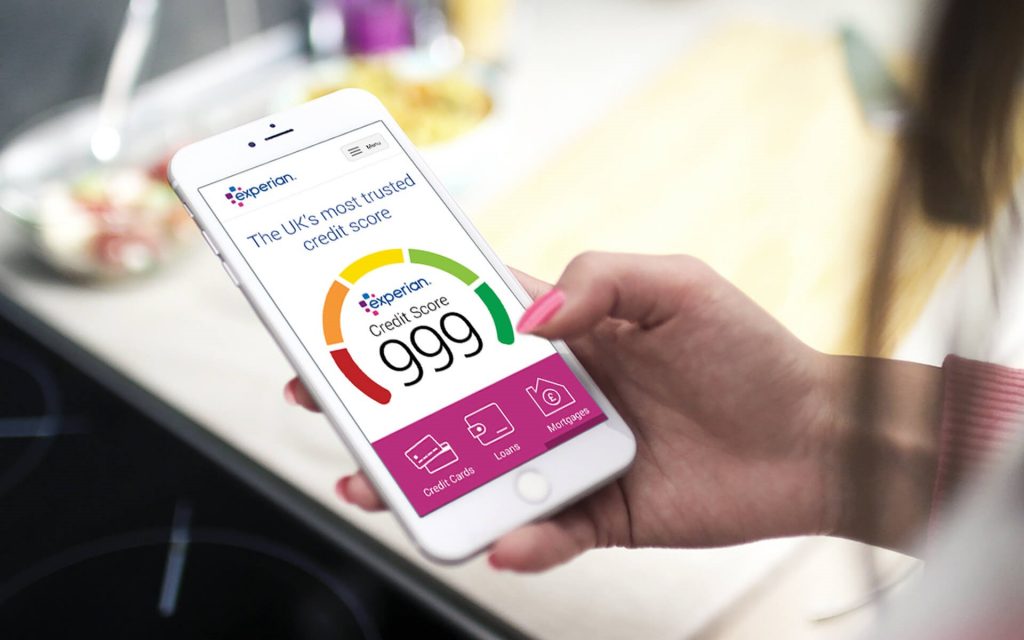

Experian Free Credit Score

The Experian free credit score system is easy to understand. Your score is rated out of 999. This is split up into five sub-divisions; Very Poor, Poor, Fair, Good and Excellent. To make it even easier to understand there is a colour coding system –

- Red for Very Poor (0-560 points)

- Orange for Poor ((561-720 points)

- Amber for Fair (721-880 points)

- Light Green for Good (881-960 points)

- Dark Green for Excellent (961-999 points)

This is nice and simple to help you to understand at a glance what is considered a good credit score and what is considered a bad credit score. However, this is also its drawback – it is rather basic.

There’s no additional breakdown as to why you have the score you have. It would have been nice to see what positives and negatives were affecting our score.

How to Get a Free Report

Everyone is entitled to one free credit report every twelve months by law. Accessing the Experian free credit score was simple enough but knowing how to get the Experian free credit report was altogether different.

Rather than have a simple link to click, it seems you have to register for Experian’s CreditExpert service. Although this is free for the first 30 days there is a monthly charge to access it after that.

There are a number of free reports online like Check my File and others, however Experian is one of the best.

There was an easy link to the Experian Statutory Credit Report service they offer which incurs a small charge, but trying to find the link to the Experian free credit report was a real task.

We did locate the page eventually but only once we had run it through a search engine first. Points deducted here.

Services and Features

The services and features are the most impressive thing about Experian. They allow you to search for credit cards, loans, mortgages, insurance and energy without damaging your credit report.

The big advantage of this is you can see what financial packages you would realistically be accepted for. This saves you a lot of time searching and a lot of worrying too.

Again, this process was easy to use and thoroughly transparent making for a pleasant user experience.

All of the above information can be accessed for free, but where Experian really excels is the Experian CreditExpert package.

Similar services can be found at Credit Angel.

We were able to use this feature thanks to the thirty day free trial which gave us plenty of time to really get to grips with what they have to offer.

It really does feel like it’s tailored to your individual needs. With everything from daily updates on your credit score to fraud alerts, it makes you feel as though they genuinely want to look after you and your finances.

They also have UK-based telephone support, so if you do have a question there is someone on hand to put your mind at ease.

What services and features do you actually get from Experian CreditExpert for your monthly fee?

- Daily Experian Credit Score and Credit Report

- The latest financial packages tailored to you

- Keep track of your score and understand how to improve it

- Web Monitoring

- Frequent reports on any changes

- UK helpline

- Experian fraud support

The monthly cost of this fantastic service is also far less than a lot of its competitors, so extra Brownie points were added because of this.

Dispute Process and File Correction

If you need to go through the dispute process and file correction is necessary then you need to be sure that the information you have is up to date.

Companies only send their data to Experian once a month and so it can take six weeks for a discrepancy to show up.

All credit report companies, including UK Credit Ratings have a specific dispute process and file correction, but we believe Experian to be one of the best.

Once you file a dispute, Experian promise to get back to you with the results within 28 days. It may sound like a long drawn out process, but there is a legal process that they are obliged to follow.

The FAQs section of the Experian website is very good at answering basic questions about your credit report.

Safety and Security

As you would expect from a company that deals with sensitive data, Experian’s safety and security policy is excellent. The two step password system means that your details are safe and secure.

Data protection is their number one priority and this was evident both when you login to your Experian account and when you contact their support team.

Help and Support

Yet another strong point of the Experian experience is their help and support network. Help and support are second to none – the staff are professional and helpful and are readily available.

By calling 0344 481 0800 you can ask questions about your credit report, seek financial advice and report cases of fraud.

Experian CreditExpert subscribers also have access to a dedicated fraud department. If you are in the unfortunate position of being a victim of fraud, it’s comforting to know that there is always someone on hand to help and reassure.

Our Verdict

Our verdict overall for credit reports is that we were very impressed with Experian. It is easy to use, self explanatory for the most part, and is genuinely helpful.

The ability to tailor your financial product checks without it affecting your credit score is a real plus, and the variety of choice is very pleasing.

The only downside we found was that it was a bit basic. If you wanted to find out why your score was at the level that it was you had to sign up for the much more comprehensive CreditExpert package.

We also struggled to find the free Experian Credit Report link but this was only a minor issue.

What is amazing about this experian free credit report checker is that it is actually free of charge where many others try to charge you money for it in hidden costs. These do not and is actually a free credit checker.

Great that you have been using it and think it is great value for money. The free report they offer is superb for running through your finances.